Asset management strategy

The wider policy context

The national context

Government policy

Many government initiatives, policy statements and/or guidance influence our asset policies, including:

- the Quirk review of ownership of public assets

- the Gershon review, and the drive to improve efficiency

- the Prudential code for the management of capital finance

- the Leaner and Greener report - delivering effective estate management

- Leaner and Greener II - putting building to work

- the Penfold review

- Laying the foundations of a housing strategy for England

- the Localism Act - community right to bid

- the community infrastructure levy (CIF)

- the national planning policy framework (NPPF)

Statutory responsibilities

We, as an employer, a landowner, a landlord and a provider of services, have a wide range of responsibilities with an implication for accommodation including:

- a range of health and safety legislation, EEC requirements. HSE best practice and guidance notes, Industry standards and Insurance requirements

- carbon reduction and energy efficiency legislation and requirements

- equality Act 2010. This does not simply encompass accessibility considerations and has to be taken in to account in virtually all development and maintenance work which is carried out to ensure that every possible aspect of disability has been considered when implementing work

- management of the risks associated with property assets including regular maintenance and servicing to address matters such as:

- legionella - a managed programme of water testing and preventative measures are carried out including weekly flushing regimes, monthly temperature tests, bi-annual bacteria testing and, as required, physical system cleansing. A robust legionella policy is in place for the council, as required by law

- asbestos - An on-going programme of surveys and management together with the use of asbestos registers and regular monitoring to prevent the release of dangerous fibres and warn of the presence of asbestos across the portfolio. A robust asbestos policy is in place for the council, as required by law

- fire safety - we undertake fire risk assessments in respect of its properties and tests fire safety equipment e.g. alarms on an annual basis. Weekly, monthly and annual testing of fire monitoring and backup systems also take place as required by the legislation to ensure that fire systems are maintained

- gas safety - Inspections and services are carried out on an annual basis to ensure that all gas appliances are safe to use. The correct pre-planned maintenance approach has also ensured that gas appliance failures are now very rare which has delivered a considerable saving in respect of reactive maintenance costs

- electrics - an ongoing program of periodic tests is carried out to fixed wiring as required by both legislation and our insurers together with portable appliance testing

- lifts, pressure vessels, safety line, chimney maintenance - checks are carried in accordance with best practice

- lightning conductors - checked in accordance with best practice

- routine inspection and repair/maintenance of assets including tree stock, playground stock, railings and structures, footpaths and roads etc.

- testing and maintenance of generators, air conditioning and mechanical services equipment

- legionella - a managed programme of water testing and preventative measures are carried out including weekly flushing regimes, monthly temperature tests, bi-annual bacteria testing and, as required, physical system cleansing. A robust legionella policy is in place for the council, as required by law

Please note: this summary is not an exhaustive list of statutory inspections or maintenance arrangements.

The local context

This asset management strategy draws from a number of our strategies and documents including:

- Sustainable community strategy

- Council plan

- Newcastle-under-Lyme and Stoke-on-Trent core spatial strategy

- Medium-term financial strategy

- Capital strategy

- Revenue and capital budget

- Urban North Staffordshire green space strategy

- Playing pitch strategy

- Economic development strategy

- Housing strategy

- Strategic housing land availability assessment

- Carbon management plan

- The Staffordshire and Stoke-on-Trent compact and third sector commissioning standards

- Safe and stronger community strategy

- Health and wellbeing strategy

- Contaminated land strategy

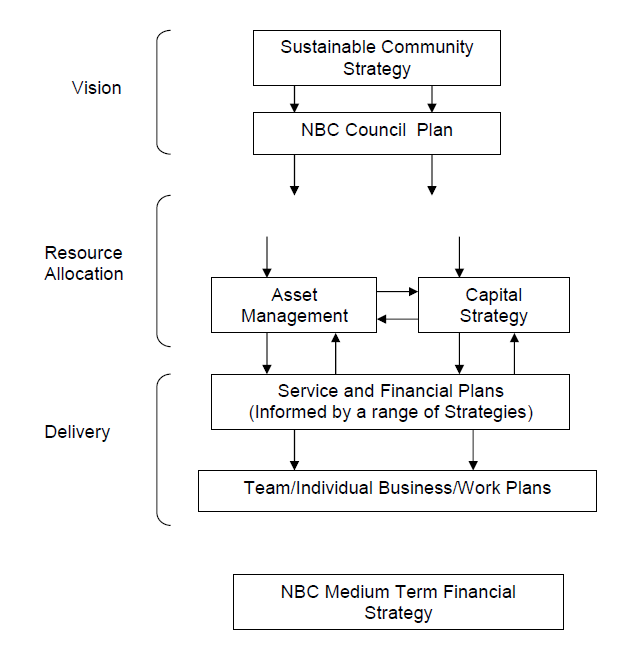

Relationship the asset management strategy has with key council/partner strategies/plans

Vision

- Sustainable community strategy

- Council plan

Resource allocation

- Asset management

- Capital strategy

Delivery

- Service and financial plans (informed by a range of strategies)

- Team/individual business/work plans

Finance

- Medium-term financial strategy

Links to our council plan

The council plan (2015-2020) had four main priority areas which were:

- becoming a co-operative council which delivers high quality community driven services

- a clean, safe and sustainable borough

- a borough of opportunity

- a healthy and active community

Funding our capital programme

The other important corporate context was provided by a Cabinet decision in autumn 2014 that future capital programmes should be funded by the realisation of capital receipts as a first resort.

Performance management context

The performance of our estate is subject to scrutiny by the Economic Development and Enterprise Scrutiny Committee with oversight, with respect to the financial elements of the strategy, also being provided by the Finance, Resource and Partnerships.

Ongoing review of assets is a key task for both managers of operational services and property-related staff. Such reviews have become formalised through a corporate officer working group, the assets review group.

The action logs of the assets review group are reported to our executive management team. Significant decisions about potential disposals or acquisitions are reviewed there and, if agreed in principle, then reported for a Cabinet decision. This may require consideration at the capital programme review group when capital expenditure over £20,000 may be required on a property or parcel of land.

The main performance indicators pertaining to our operational and commercial property portfolios are listed below:

- percentage of the investment portfolio which is vacant

- percentage of investment portfolio in arrears

- percentage of statutory inspections completed on time

Other performance indicators (relating to the maintenance of buildings) have recently been introduced these being:

- percentage reduction in energy consumed

- time taken to respond a to repair

Partner organisations

Community leadership is often delivered through partnership, and it is probably seen in the best light when it tackles 'cross-cutting' issues.

The Newcastle Partnership brings together key players from the public, private and voluntary sectors with the aim of enhance the quality of life of local communities. Two key priorities have been identified around enhancing economic growth and tackling vulnerability, based on our key strategies. The partnership has developed a work programme focused on these key priorities and has in place a number of projects designed to deliver against this work programme. Our ability to lead and contribute to partnerships is increasingly important to help us secure improvements in service delivery through the physical estate for the residents, investors and visitors to the borough.

Staffordshire and Stoke-on-Trent Local Enterprise Partnership (LEP)

The Local Enterprise Partnership (LEP) is a private sector-led partnership with the public sector which aims to drive economic growth and create jobs. Formed in 2011, the LEP's vision is to create 50,000 jobs and increase the size of the economy by 50% by 2021. The LEP creates opportunities for business by providing;

- advice, support and skills development

- creating the opportunity for businesses to access funding through funding streams such as the growing places fund, driving forward strategic investment in infrastructure

- major initiatives such as the City Deal - Powerhouse Central

Our land disposal strategy supports this growth initiative by creating the opportunity to dispose of surplus land to facilitate economic growth and add to the housing offer available within the Borough in line with both the LEP growth ambition and government policy. Additionally, the master planning exercise which is to take place over the future use of the former Keele Golf site and the land to the west and south of urban Newcastle has the potential to support further development of Keele University and Science Park as a major employment and growth hub within the borough (subject to the outcome of the local plan process).

Newcastle town centre partnership

Newcastle and Kidsgrove town centre partnerships are private sector-led partnerships which have been established to bring together local businesses and ourselves to improve the economic fortunes of the town centres.

Disposals to third sector

For a number of years, we have pursued a policy of disposal of assets to the 'third sector' through the engagement of active community groups. Our disposal strategy in respect of these groups recognises the strengths of pro-active community organisations - independence, specialist knowledge of particular activities, community focus and access to third sector funding streams.

We seek to support these organisations by adopting a number of different approaches to community engagement and management of assets. The approaches range from a totally devolved community management structure - where the asset is leased to an organisation who then assume complete control of it including repairs/maintenance, running costs etc. and who also receive and control income generated by the asset (for example letting to Newcastle Rugby Club) - through to a supported management structure where we retain responsibility for the costs associated with the asset and the income generated by it, for example, football pitches - and onto a 'stewardship' role for the community where volunteers or friends groups provide an input and influence to our management decisions.

In some cases, this involves granting long leases of land and property to third sector organisations at nominal rentals. The grant of such leases, as opposed to outright disposal of the freehold, ensures that where such groups experience problems, (for example through loss of key members), the asset (land/property) returns to us (and the greater community) to be utilised again for a similar purpose or some other purpose outlined in the corporate priorities. Examples of successful leases (typically of 20/25 year duration) previously established by us include:

- Kidsgrove Ski Club

- Newcastle Town Football Club

- Newcastle and Hartshill Cricket Club

- Newcastle Rugby Club

- North Staffs Special Adventure Playground

- Kidsgrove Citizens Advice

There are also a number of examples of community green spaces which are managed and/or leased by local community groups, including:

- Audley Millennium Green

- Lyme Valley allotments

In addition, our Facilities team have assisted community groups/sporting organisations relating to project managing improvement schemes recent examples include the rebuilding of the bowls pavilion at Westland Sports Ground and the planned/committed refurbishment of the sports centre in the Lyme Valley.

Capital programme and stock condition

Another key area relates to the maintenance and repair of the significant operational land and buildings. Whilst key properties remain under review (for example the civic offices) a modest investment programme has been approved annually as part of our capital programme. Provision is made in our general fund revenue programme annually to meet the ongoing costs relating to land and property maintenance.

This maintenance or repair work is driven by the review of the stock condition survey which is assessed annually in order that a clear record of the condition and repair of the assets is maintained. This enables the identification of major repairs requiring capital investment. In addition any assets which require urgent attention due to health and safety risks will be highlighted and prioritised to ensure that we comply with its statutory requirements.

A stock condition review has been carried out again in 2014 and moving forward the repairs identified have been categorised (RAG-rated) as:

- red (urgent repairs required to meet health and safety obligations or similar imperative)

- amber (repairs which can be left in abeyance for a short time but will result in deterioration of the asset as time goes on)

- green (repairs which can be put in a planned maintenance programme spread over a number of years)

This has enabled preparation of an indicative costed and planned schedule of capital works over a 5 year period to enable better planned maintenance and capital finance planning.

In assessing the future maintenance repair of our operational estate there will need to be a balance between providing the financial resources to undertake a pro-active maintenance programme and the risk that not doing so will impact on future capital costs (since the fabric of assets will deteriorate over time and maintenance work will become more costly due to this).

Summary of the likely stock condition survey cost requirements 2015-18

- 2015-16 - £447,500

- 2016-17 - £1,529,150

- 2017-18 - £1,882,680

Planned maintenance and improvement 2014-16

Whilst it might be desirable from an asset management viewpoint for us to move towards a planned maintenance programme in the next few years based on the stock condition survey, given competing priorities for expenditure and limited available capital funds this strategy adopted a targeted approach to investment for 2014-15 and into 2015-16 as follows:

- former St. Giles and St. George's School - maintain whilst clarifying end use (current preferred location for new civic offices)

- Clayton sports ground - drawings and specifications for a new roof to the sports hall, a new heating system together with part refurbishment of the interior of the facilities in order to extend the life of the building and provide enhanced facilities were prepared for a tender exercise to be carried out during the winter of 2014-15. It is planned to start the work in the Spring of 2015 to take advantage of better weather conditions. The majority of the cost is to be financed by various external grant funds. We are also exploring other possible funding opportunities from badminton organisations which could potentially fund a new sports hall floor and full redecoration of the hall

- civic offices - essential works to upgrade the electrical system were undertaken in 2014-15 and this continued in the following two years

- entire corporate portfolio - fixed wiring testing and associated remedial works carried out in 2015

- public car parks - urgent resurfacing where necessary to mitigate risks

- Brampton museum - exterior repairs and redecoration

- High Carr Farm - new windows and porch

- industrial units at Brampton Sidings and Croft Road - major overhaul of leaking roofs with rubber solution to achieve a 20 year lifespan

- Roe Lane and Birchenwood pavilion - installation of new self-flushing showers

- Silverdale Community Centre - demolition of structurally unsound part of building

- Guildhall - interior decoration

- accommodation review - undertake further work to establish the medium to long term accommodation needs of both ourselves and other public sector partners to secure more efficient occupation of operational buildings

- further high priority improvement works to other community centres and potential tenanted properties to preserve the assets and enhance potential rental income

As with the capital programme, due to limited availability of revenue funds, planned maintenance work continued at minimum levels for 2014-15 and a more reactive approach was adopted and this continued into 2015-16. Consequently it is inevitable that the condition of property assets will deteriorate until a more proactive maintenance programme can be funded. With regard to maintenance of land this is restricted to urgent health and safety works and prioritised works to preserve reasonable levels of amenity.

Structures - bridges, watercourses etc.

An asset register of all structures for which we are responsible has been prepared. A full inspection programme was implemented to monitor the condition of the structures and identify any repairs during 2014-15 and 2015-16 so that we were fully informed of the liabilities and responsibilities. A risk-based and targeted approach for future inspection regimes will be undertaken in future years to identify any maintenance or repair needs. It was already known that there was a partial retaining wall collapse which required substantial rebuilding for health and safety reasons during 2015 and this is reflected in the stock condition survey. Three churchyard retaining walls have required repair and part rebuilding as a result of this survey and iinspection work, but to date no work of a major concern has been identified.

The inspections are ongoing and any immediate repair requirements will be carried out upon identification, however, until the full inspection regime is completed it is only possible to estimate the full extent of our liabilities over the next 5 years.

Carbon reduction and energy efficiency

We monitor energy use in all operational properties. We have been seeking to reduce energy usage over the last 2 years and where we carry out repairs or improvements to the properties, we seek to reduce our carbon footprint/energy use further as a direct result of these works, thereby saving costs.

We published a carbon management plan in 2011 (accredited by the Carbon Trust). This developed a carbon management strategy which identified the drivers for carbon management, targets and objectives to be achieved and the strategic themes considered. In order to deliver these objectives, the plan sets out a number of projects. There are:

- existing projects

- planned/funded projects

- short term projects

- medium to long term projects

In October 2011 we received a grant allocation of £35,000 from the West Midlands Low Carbon Fund to reduce our carbon footprint which in turn will save money in respect of energy consumption. A number of energy saving proposals were implemented in the spring of 2012 using this grant money. Some of the notable examples are set out below:

- automated meter readers (AMRs) were fitted on gas and electricity supplies to our 5 highest energy-consuming buildings. Additionally the majority of operational buildings have had electricity AMRs fitted at no cost to us

- cavity wall and/or loft insulation at several premises

- low energy lighting, lighting controls and double glazing at several premises

- installation of low energy hot water system in one location

As a result of the installation of AMRs to a number of sites, we have developed a robust web-based energy management database which has energy consumption automatically uploaded from the information supplied by AMRs and half hourly meters which allows monitoring of energy consumption (on a half hourly, daily, weekly monthly and annual cycle), measuring consumption, carbon dioxide emissions, peaks of consumption and comparisons with previous years. This has enabled our officers to adopt a more proactive approach to energy management which helps in identifying peak and unusual usage and eliminating waste or unnecessary usage. Together with the installation of PIRs in a number of sites this has contributed to a reduction in the overall consumption of electricity by 31% during 2012-13 and 2013-14 as compared to 2011-12.

Particular examples from the projects undertaken are 23% reduction in electricity consumption at Bathpool Park (which is heated by electric convector heaters and where cavity wall installation has been installed). At Midway, Merrial St, Hassell Street, the crematorium and Birchenwood Pavilion where a combination of PIRs and energy efficient water heaters were installed, the reduction in energy usage has been 13%, 83%, 8% and 179% respectively. In the case of Midway alone the modifications carried out resulted in a saving in electricity of £4,000 for the year.

Further work is being carried out to source funding in order to implement more of the planned projects (set out in the carbon management plan) which would help to further reduce our carbon footprint and save both energy and costs.

Additionally other initiatives being explored included:

- LED lighting at the depot and civic offices

- bio mass projects (wood burners)

- heat recovery schemes

Strategic property review

It is essential that we have an efficient property assets approach to ensure that all opportunities to maximise use, rental income, resources and management are taken.

We have a property portfolio with a capital value of about £19 million from which a rental income of about £1.23 million per annum is derived. This represents an average gross return on investment of 6.5% per annum. It is noteworthy that should we decide to sell all of these assets and invest the money in recognised investment schemes, the gross return on this investment would be approximately 1% per annum.

Therefore in general, we are obtaining a better return from holding the property portfolio and the strategy should concentrate on maximising the efficiency of the property portfolio so that each property achieves an optimum return or more and resources should be concentrated on those buildings which achieve this. As a matter of principle, properties which do not comply with this strategy should be considered for disposal (where there is a market demand) in order that proceeds can be used in part or whole to re-invest in good performing buildings to protect and enhance their returns.

Where failing properties are disposed of, this will take pressure off capital budget requirements as the need for expenditure decreases. However, it should be recognised that there is a consequent loss of rental income in the short term. There have been examples of this approach during the past year.

Over the long term, by investing in more efficient properties to increase and enhance their value, not only should the loss of income be retrieved by the increase in rental value of the asset, the asset itself will increase in value and the probability of a long term rental income will be enhanced considerably.

Each property asset from both portfolios will need to be scrutinised in detail in terms of operational use, maximisation of use, rental income, maintenance cost, capital requirements and general overheads in order that individual property needs or failings can be identified and this will deliver an overall strategic plan for all the property assets.

However, this exercise will also need to take in to account operational requirements and the need to hold some property for long term strategic and regeneration needs so there will be occasions when under-performing properties are retained.